Companies increasingly turn to customer relationship management (CRM) systems to streamline processes and enhance customer satisfaction in the ever-evolving business operations landscape. However, integrating a CRM system isn’t just about improving workflows or communication. It’s also about assessing its financial and operational impact on the business. To evaluate CRM integration, organizations must measure its return on investment (ROI) and overall business impact. One critical area where CRM integration shines is in improving accounts receivable management.

Understanding CRM Integration

Connecting a CRM platform with other corporate systems—such as marketing automation, financial tools, and enterprise resource planning (ERP)—is known as CRM integration. This interdependence guarantees data moves between departments, facilitating improved operational effectiveness and decision-making. Combining CRM with accounts receivable systems, for instance, lets companies track payments, handle bills, and increase cash flow.

Still, why evaluate ROI? Any technical investment should show noticeable results. In areas like accounts receivable, organizations can assess ROI to determine whether their CRM system meets expected objectives.

The Role of CRM in Accounts Receivable

Accounts receivable, or the money owed to a company by its clients, is a significant gauge of a company’s financial situation. Delayed payments can cause operational inefficiencies, limit growth prospects, and strain tax cash flow. Combining accounts receivable tools with a CRM system can automatically generate invoices.

- Track pay in real-time.

- Consolidating interactions connected to payments will improve consumer communication.

- Point out possible problems early on and note payment patterns.

- By addressing these elements, companies can lower their risk of bad debt and enhance their cash flow control.

Measuring ROI: Key Metrics

Businesses should focus on specific metrics to measure the ROI of CRM integration, especially for accounts receivable. These include:

1. Reduction in Days Sales Outstanding (DSO)

DSO measures the average days to collect payments after a sale. A lower DSO indicates faster payment collection. CRM integration can streamline this process by automating reminders and providing clear visibility into outstanding invoices.

2. Improvement in Cash Flow

Integrating CRM with accounts receivable systems ensures timely invoicing and payment follow-ups, directly impacting cash flow. Improved cash flow can lead to better investment opportunities and operational flexibility.

3. Cost savings

Reduce manual work, leading to labor savings and error reduction. This efficiency is particularly significant in managing accounts receivable, where errors can lead to payment delays or disputes.

4. Customer Satisfaction

A CRM system centralizes communication, ensuring customers receive consistent and timely updates regarding invoices and payments. Satisfied customers are more likely to pay on time and continue doing business with the company.

5. Insufficient Debt Reduction

Proactive tracking and communication facilitated by CRM systems help identify at-risk accounts before they become uncollectible. By addressing issues early, businesses can minimize bad debt.

Steps to Measure ROI

1. Set Clear Objectives

Before integrating a CRM system, define. This could include reducing DSO by 20% or cutting invoicing errors in half for accounts receivable.

2. Collect Baseline Data

Gather data on current performance metrics, such as DSO, cash flow, and harmful debt levels, to establish a starting point for comparison.

3. Track Performance Post-Integration

After implementing the CRM system, monitor the same metrics over a defined period. Use dashboards and reports to analyze trends and identify areas of improvement.

4. Calculate ROI

The ROI formula is:

ROI (%) = [(Net Benefits – Total Costs) / Total Costs] x 100

For CRM integration, net benefits include increased revenue from faster payments and cost savings from automation, while total costs encompass software, training, and maintenance expenses.

Challenges in Measuring ROI

Despite its importance, measuring the ROI of CRM integration can be challenging. Businesses often encounter difficulties such as:

Data Silos:

Inconsistent data across systems can skew results.

Intangible Benefits:

Factors like improved customer satisfaction are more complex to quantify.

Time Lag:

ROI may not be immediately apparent as benefits accumulate.

To overcome these challenges, businesses should adopt a holistic approach, considering both quantitative and qualitative outcomes.

Business Impact Beyond ROI

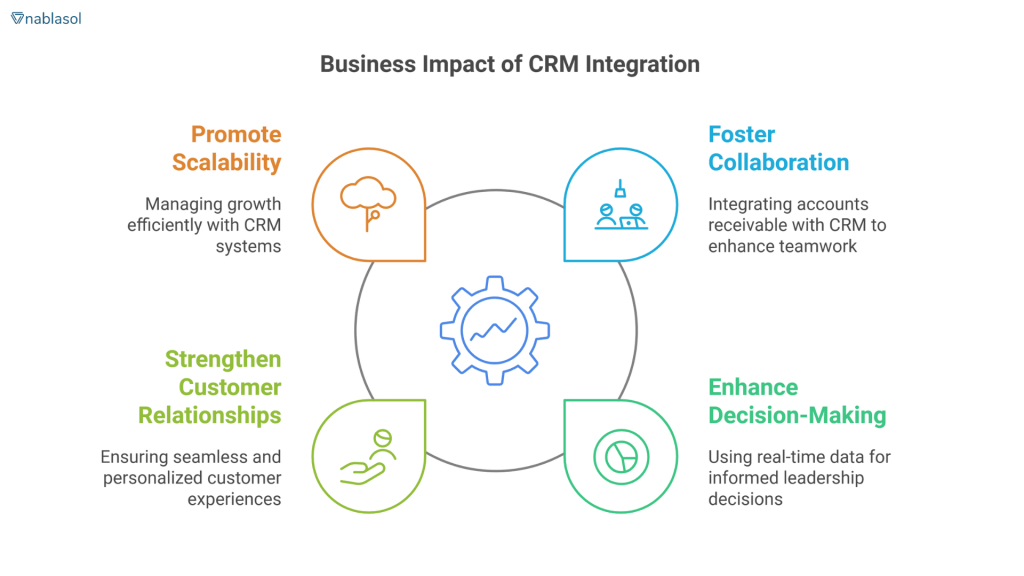

While ROI focuses on financial returns, CRM integration’s business impact extends beyond dollars and cents. When implemented effectively, CRM systems can:

Foster Collaboration

By integrating accounts receivable with CRM, sales and finance teams can work together more effectively. For example, sales teams can access payment histories to guide customer conversations, while finance teams can use CRM insights to forecast revenue.

Enhance Decision-Making

Real-time data provided by CRM systems enables leaders to make informed decisions. For example, knowing which accounts might be prone to late payments helps companies prioritize follow-up and deploy funds wisely.

Strengthen Customer Relationships

A well-integrated CRM system ensures a seamless customer experience. From personalized payment reminders to easy dispute resolution, these enhancements build trust and loyalty.

Promote Scalability

As businesses grow, managing accounts receivable manually becomes increasingly complex. CRM integration provides the scalability needed to handle larger volumes of transactions without sacrificing efficiency.

Best Practices for CRM Integration

Companies trying to simplify processes and increase customer involvement depend on customer relationship management (CRM) solutions. A good CRM integration guarantees that all critical business operations—including sales, marketing, and customer service—work perfectly together. Among these tasks, managing accounts receivable inside your CRM system will significantly improve financial control and efficiency. We will discuss best practices for CRM integration in this blog, especially with an eye toward accounts receivable function.

Understanding CRM Integration

CRM integration connects your CRM software with other essential tools and systems in your organization. It enables the free flow of information across departments, minimizing manual data entry and improving data accuracy. Effective integration enhances customer experiences and boosts internal productivity.

CRM integration supports better decision-making and allows businesses to automate repetitive tasks when done correctly. For instance, integrating accounts receivable with your CRM ensures that all financial data is up-to-date and readily accessible, helping your team manage customer invoices and payments more effectively.

Why Accounts Receivable Matters in CRM Integration

The financial situation of a corporation depends much on its accounts receivable. By integrating accounts receivable into your CRM system, you can:

Improve Cash Flow Management:

A unified view of outstanding payments helps prioritize collections and maintain consistent cash flow.

Enhance Customer Insights:

Understanding a customer’s payment history provides valuable insights for personalized service and risk assessment.

Streamline Operations:

Automated invoicing and payment tracking reduce administrative workloads.

Given its importance, integrating accounts receivable should be a priority during the CRM implementation process.

Best Practices for CRM Integration

Define Clear Objectives

Before initiating CRM integration, outline your objectives. Identify specific goals, such as improving customer engagement, streamlining accounts receivable, or enhancing reporting capabilities. Having clear objectives ensures that the integration aligns with your business needs.

For example, if your goal is to optimize accounts receivable processes, focus on integrating tools that support invoice generation, payment reminders, and real-time financial reporting.

Choose the Right CRM and Tools

Selecting a CRM system that supports integration with your existing tools is essential. Evaluate software options based on their compatibility with accounting systems, payment gateways, and other financial tools. Popular CRMs like Salesforce, HubSpot, and Zoho offer extensive integration capabilities, making them ideal for businesses with complex needs.

When choosing tools to manage accounts receivable, ensure they can seamlessly connect with your CRM. This connectivity allows for automated data synchronization, minimizing errors and redundancies.

Focus on Data Quality

The success of CRM integration heavily depends on data quality. Clean, accurate, and up-to-date data ensures smooth operations and reliable reporting. Conduct a thorough data audit before integration to eliminate duplicates, errors, or outdated information.

Review and update accounts receivable data regularly to maintain accuracy. This practice prevents issues like sending invoices to incorrect addresses or miscalculating outstanding balances.

Leverage APIs for Seamless Integration

CRM integration depends on application programming interfaces (APIs). APIs let many software programs effectively exchange data and interact. Integrating accounts receivable technologies with your CRM via APIs guarantees real-time data synchronization and lessens manual interventions.

An API connection, for example, can immediately change your CRM’s payment statuses, guaranteeing that your staff has the most recent financial data.

Train Your Team

CRM integration depends on a well-trained crew. Ensure staff members can efficiently utilize the combined system and grasp the new processes. Organize training courses stressing the advantages of accounting for receivable integration and showing how to apply pertinent tools.

Get comments from your staff to spot areas needing work and possible difficulties. Employees who receive constant training and support will be more quickly adaptable to the system.

Prioritize Security and Compliance

CRM integration depends critically on data security. First and foremost, it should safeguard private client and financial data. Install strong security systems, including frequent audits, multi-factor authentication, and encryption.

Verify adherence to pertinent rules, including GDPR, CCPA, or industry-specific criteria. Integrating accounts receivable ensures that payment data is handled safely and follows financial rules.

Test and Monitor the Integration

Establishing CRM integration requires thorough testing beforehand. Pilot testing lets you find problems and quickly fix them. Test all features—including accounts receivable systems—to guarantee flawless performance.

Once the integration is live, watch its performance often. Using analytics instruments, track essential benchmarks such as invoice processing times and payment collection rates. Constant observation guarantees that the system stays efficient and helps find development areas.

Automate Accounts Receivable Processes

Automation is a key benefit of CRM integration. By automating accounts receivable processes, you can save time and reduce errors. For example:

- Automatically generate and send invoices to customers.

- Set up payment reminders for overdue accounts.

- Update payment statuses in real time.

Automation frees your staff to concentrate on more essential chores, such as building client relationships or analyzing financial trends.

Align Integration with Business Goals

Integration of CRM should enable your main corporate goals. To raise customer happiness, ensure the integration improves communication and offers a complete picture of client contacts.

Integration should streamline accounts receivable transparency and financial procedures. Matching integration initiatives with corporate objectives guarantees that the system generates real advantages.

Seek Expert Assistance

CRM integration can be complex, especially for businesses with unique requirements. To ensure a smooth implementation, consider working with experienced consultants or integration specialists. Experts can provide valuable insights, recommend best practices, and help avoid common pitfalls.

Common Challenges and Solutions

Challenge 1: Data Silos

Data silos occur when information is isolated within different systems or departments. This fragmentation can hinder effective CRM integration.

Solution:

Integrate all relevant tools and systems to create a unified data repository. Use middleware solutions or APIs to bridge gaps and ensure seamless data flow.

Challenge 2: Resistance to Change

Employees may resist adopting new systems, especially if they are unfamiliar with the technology.

Solution:

Provide comprehensive training and highlight the benefits of CRM integration. Address concerns and involve employees in the integration process to gain their support.

Challenge 3: Integration Complexities

Technically demanding and time-consuming is integrating several systems.

Solution:

Break the integration process into manageable phases. Focus on high-priority areas, such as accounts receivable, before expanding to other functions.

Measuring Success

To evaluate the effectiveness of your CRM integration, track key performance indicators (KPIs) such as:

- Calculates the accounts receivable turnover of your business—payment collecting effectiveness.

- Track the time it takes to produce and mail invoices.

- Customer Payment Trends: Reveals possible hazards and offers an understanding of payment practices.

- Review these numbers often to ensure your CRM integration produces the intended results.

Conclusion

Ensuring the investment shows accurate results depends on knowing CRM integration’s ROI and business impact. Faster payments, better cash flow, less bad debt, and more customer satisfaction define the clear benefits of accounts receivable. Businesses can fully realize CRM systems by concentrating on essential indicators, tackling problems, and implementing best practices.

The integration of CRM is ultimately a strategic endeavor that propels efficiency, teamwork, and expansion rather than only a technological improvement. Whether your company is small or large, using CRM with accounts receivable capabilities will help you toward financial stability and long-term success.