Customer-customer relationship management (CRM) systems have become essential for many firms. Regarding customer relationship management, process simplification, and business expansion driving potential, CRMs offer a unique advantage for tax practitioners. By understanding how a CRM attracts and retains tax clients, professionals may maximize its ability to increase client satisfaction and revenue.

What is a CRM, and Why is it Important for Tax Professionals?

CRM systems help businesses manage communications with prospects and customers. They execute administrative tasks automatically, keep customer data close at hand, and maintain correspondence. For tax professionals, a CRM is more than just a contact database; it’s a whole system that enables creative marketing initiatives, fast communication, and imaginative client management.

Often juggling many clients with legal obligations and rigorous deadlines, tax professionals balance these. By using tools to track deadlines, manage customer interaction, and assess corporate success, a CRM helps to streamline these activities. Using a CRM that fosters loyalty and attracts new business, tax firms can create a client-centric approach.

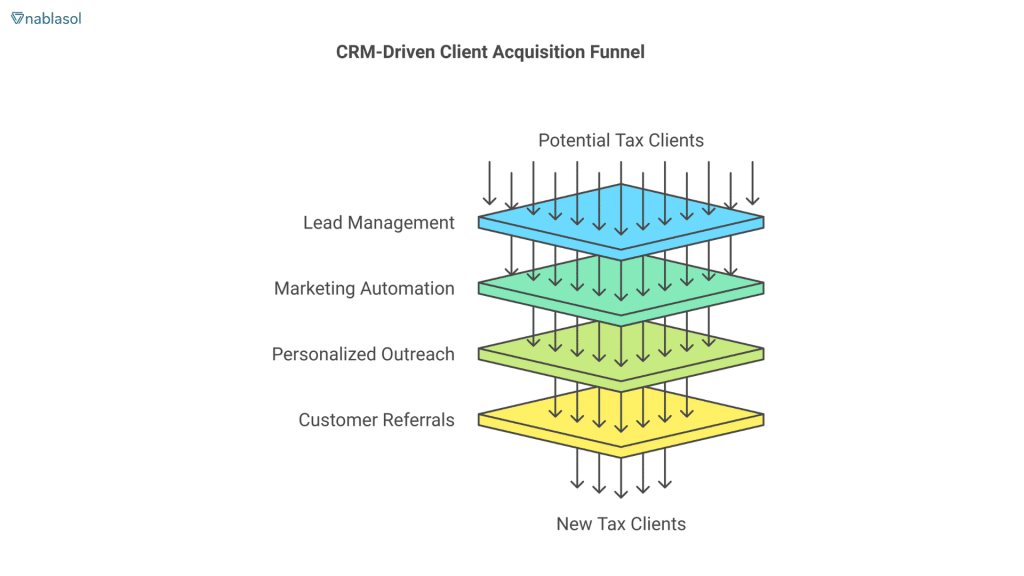

The Role of CRM in Attracting New Tax Clients

Attracting new clients is vital for the growth of any tax practice. A CRM supports this goal in several ways:

Lead Management

Tax experts can effectively monitor possible clients because a CRM system centralizes all lead data. CRMs use features to categorize leads by sector, income level, or tax needs, enabling top priority for high-value prospects. Tax companies can ensure they follow up with leads on time and lose potential customers less often if they track where leads are in the sales process.

Marketing Automation

Good marketing calls for deliberate, continuous outreach. CRM systems allow tax companies to track interaction, automate email campaigns, and customize marketing messages to particular groups. For example, a tax professional could present themselves as a proactive and knowledgeable expert by sending newsletters with tax-saving tips or notices of upcoming tax dates.

Building Trust with Personalized Outreach

Personalizing is one perfect way to start building confidence. Every prospect has extensive data kept in CRMs covering past interactions and financial situation information. This data allows tax professionals to address possible customers personally with customized messaging. Customizing a plan will make a long-term client relationship firmly based and significantly increase conversion rates.

Using Customer Referrals

Happy customers are among the best sources of new business. A CRM lets one monitor referral campaigns and find top referrers. Automated technologies can also send thank-you notes or awards to customers who bring in fresh business. Tax professionals can develop client relationships through a CRM to transform contented customers into brand champions.

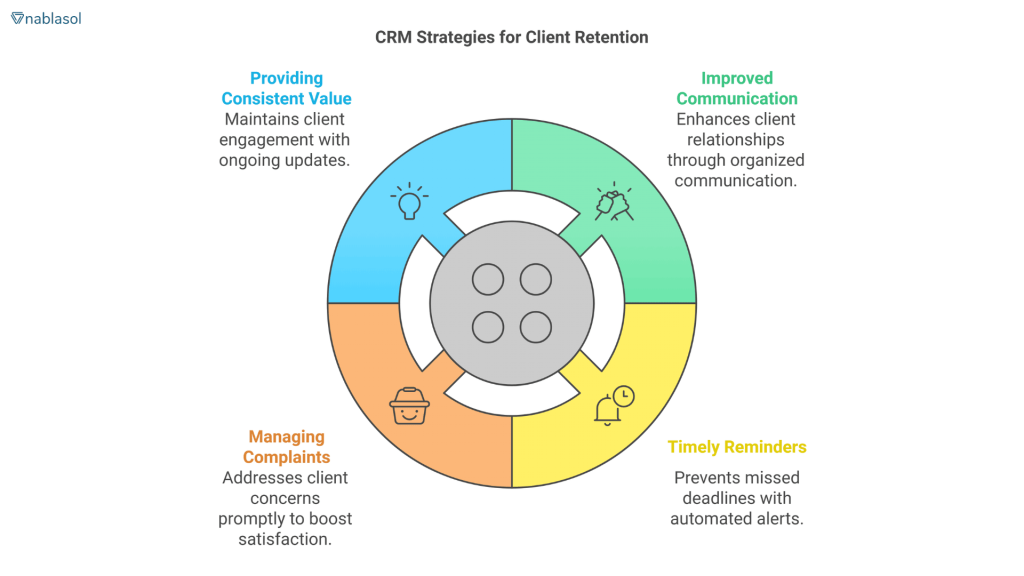

The Role of CRM in Retaining Existing Tax Clients

Retention is as necessary as acquisition in building a sustainable tax practice. CRMs provide tools to enhance client loyalty and satisfaction:

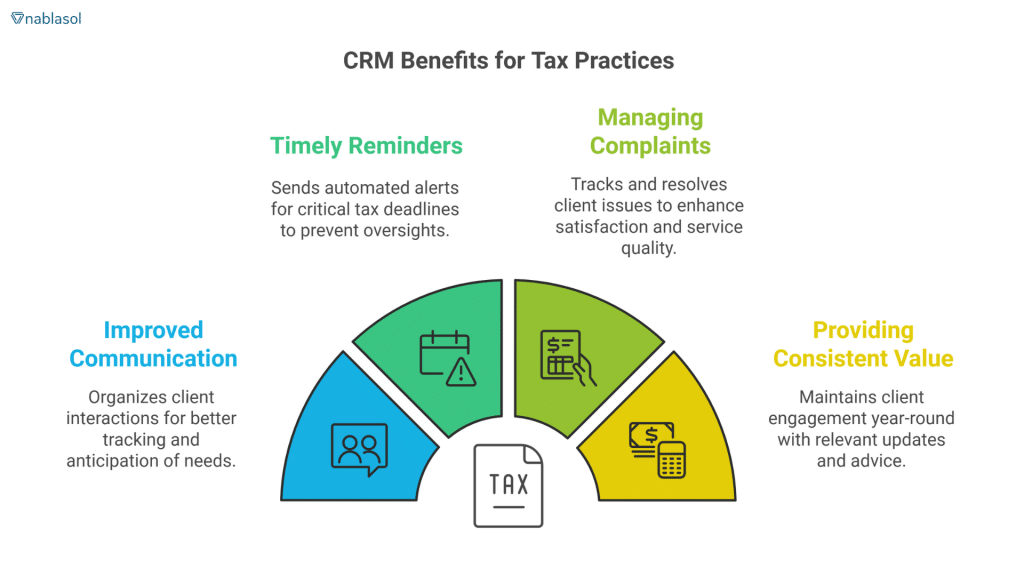

Improved Communication and Client Relationships

A CRM organizes all client communication in one place, making it easy to track previous conversations and anticipate future needs. With a CRM, tax professionals can ensure no email or phone call is missed, demonstrating reliability and commitment to their clients.

Timely Reminders for Deadlines

Missing a tax deadline can harm both the client and the tax professional. CRMs can send automated reminders for critical dates, such as filing deadlines or payment schedules. Tax professionals can build trust and prevent costly oversights by keeping clients informed.

Managing Client Complaints and Feedback

Clients appreciate it when their concerns are addressed promptly. A CRM system allows tax professionals to track complaints, document resolutions, and identify recurring issues. This improves client satisfaction and helps refine services to meet client expectations better.

Providing Consistent Value

CRMs enable tax professionals to stay connected with clients throughout the year—not just during tax season. Tax firms can demonstrate their ongoing value and reinforce their role as trusted advisors by sharing relevant updates, tips, or industry news.

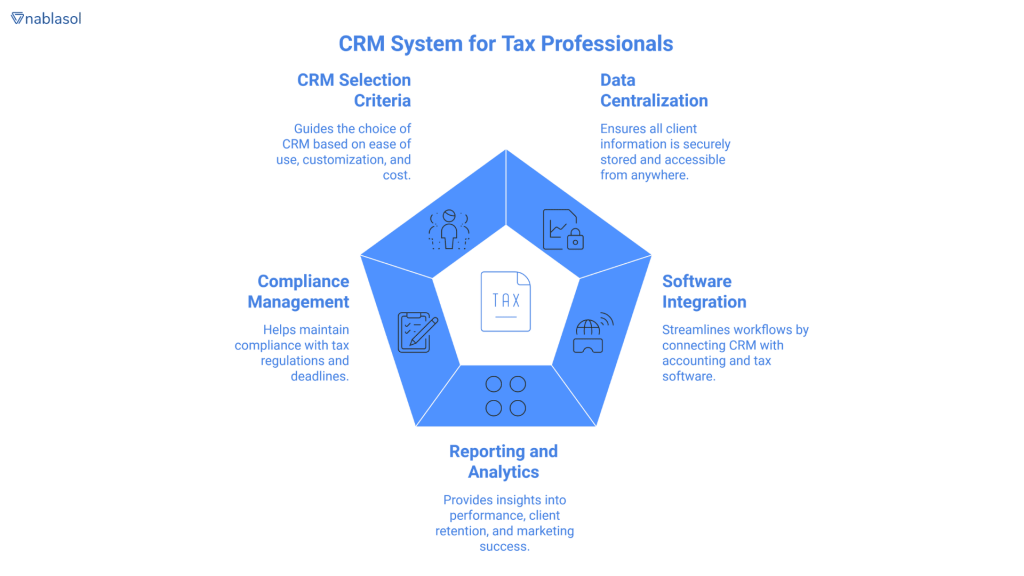

Key Features of a CRM System Designed for Tax Professionals

When choosing a CRM, tax professionals should look for features tailored to their unique needs.

Data Centralization and Accessibility

A centralized database ensures that all client information is stored in one secure location. With cloud-based CRMs, tax professionals can access client data from anywhere, making working remotely or during client meetings easier.

Integration with Accounting and Tax Software

Integrating a CRM with existing tax software streamlines workflows and reduces manual data entry. For instance, syncing a CRM with accounting software can provide a complete view of a client’s financial situation, helping tax professionals deliver more accurate and comprehensive advice.

Reporting and Analytics

Robust reporting and analytics features provided by CRMs let tax companies monitor performance. These revelations can highlight areas needing work, measure client retention rates, and spot successful marketing initiatives. Using data-driven judgments can help tax experts improve client happiness and hone their approaches.

Compliance Management

Maintaining compliance with tax regulations is critical to a tax professional’s work. CRMs can store and organize essential documents, ensuring client records are accurate and up-to-date. Some CRMs even include tools to monitor compliance deadlines, helping tax firms stay ahead of regulatory requirements.

Choosing the Right CRM for Your Tax Practice

Selecting the right CRM is critical to ensuring it meets the specific needs of your tax practice. With numerous options available, evaluating the features and benefits of different systems is essential.

Factors to Consider

When choosing a CRM, consider:

- Ease of Use: A CRM should be intuitive and user-friendly to avoid wasting time on complex training.

- Customization Options: Your tax practice may have unique workflows. A customizable CRM allows you to tailor features to your requirements.

- Integration Capabilities: Ensure the CRM integrates seamlessly with your existing tax and accounting software, such as QuickBooks or Xero.

- Scalability: As your practice grows, the CRM should be able to scale to handle more clients and data.

- Cost: Evaluate pricing models to ensure the CRM provides value without exceeding your budget.

Custom CRM Solutions

Custom CRM solutions might be the answer for tax practices with particular requirements. These systems are built from scratch or heavily customized to align with your workflows. While the upfront cost may be higher, custom CRMs can deliver unmatched efficiency and flexibility.

Challenges in Implementing a CRM and How to Overcome Them

While a CRM offers significant benefits, implementation can pose challenges:

- Data Migration: Transitioning from spreadsheets or outdated systems can be complex. To address this, work with a CRM provider offering migration support.

- Resistance to Change: Team members may hesitate to adopt new technology. Overcome this by offering training sessions and emphasizing the long-term benefits.

- Cost Concerns: CRMs can be seen as a significant expense. However, the ROI should be considered for improved client retention and streamlined workflows.

- Integration Issues: Not every CRM smoothly connects with current systems. Investigate carefully and choose systems with known compatibility.

Streamlining Tax Workflows with CRM Integration

When you work in tax, you must always be quick and accurate. Keeping track of important papers, managing client interactions, and ensuring payments are made on time are all essential tasks that need careful attention. Putting together Customer Relationship Management (CRM) tools with document management systems (DMS) and accounts receivable (AR) solutions can change how tax pros handle these tasks, making workflows easier, improving accuracy, and making clients happier.

The Challenges of Managing Workflows in Tax Firms

Tax professionals often juggle multiple responsibilities, including handling client communications, maintaining compliance documentation, and ensuring on-time payments. However, traditional methods of managing these tasks can be cumbersome:

- Fragmented Systems: Many firms use separate tools for client management, document storage, and payment tracking. This leads to inefficiencies as data has to be manually transferred or duplicated across platforms.

- Manual Errors: Human input increases the likelihood of errors in data entry, filing, or communication, which can have costly implications in the tax industry.

- Time-Intensive Processes: Searching for documents, following up on overdue payments, or maintaining accurate client records can consume valuable time.

These challenges underscore the need for an integrated solution that connects CRM systems with DMS and AR tools.

What is CRM Integration?

CRM integration involves connecting a customer relationship management platform with other software solutions to enable seamless data sharing and functionality. When integrated with document management and accounts receivable systems, a CRM is a central hub, consolidating information and processes.

Such integration offers immense value for tax professionals. It streamlines administrative tasks and ensures that client data, financial records, and essential documents are readily accessible, accurate, and secure.

Key Benefits of CRM Integration for Tax Professionals

Centralized Data Access:

One significant benefit of combining CRM with DMS and AR systems is that client information can be accessed anywhere. Tax experts can see all information about a client, such as messages, documents, and payment histories, in one place. This eliminates the need to switch systems, speeding things up and reducing mistakes.

Example: When preparing a tax return, a professional can instantly access the client’s financial documents, previous filings, and payment records without navigating multiple systems.

Enhanced Collaboration:

Integrated systems foster better collaboration among team members. When data is updated in real-time, everyone in the firm can access the latest information, ensuring consistency across departments.

Example: Tax preparers can immediately see this in the CRM if an accounts receivable team updates a client’s payment status. This transparency minimizes communication gaps.

Improved Document Management:

Tax professionals handle many documents, including tax returns, compliance forms, and client agreements. Integrating CRM with a document management system ensures that these files are organized, searchable, and securely stored.

Benefits include:

- Automatic categorization and tagging of files.

- Version control to prevent confusion over outdated documents.

- Secure sharing options to comply with data protection regulations.

Streamlined Accounts Receivable Processes:

Late payments can hurt cash flow and strain client relationships. When CRM systems are tied to AR systems, automated payment reminders are sent out, past-due invoices are tracked, and online payments can be made directly through the CRM.

Example: A client who receives an automated reminder about an overdue invoice can pay through a secure portal, which updates their record in the CRM and marks the invoice as paid in the AR system.

Time-Saving Automation:

Automation is a game-changer for tax professionals. Integrated systems can automate repetitive tasks like sending reminders, updating client records, or generating reports. This allows professionals to focus on value-added activities such as strategic tax planning or client consultations.

Enhanced Compliance and Security:

Tax professionals must adhere to strict compliance standards. Integrated systems ensure that all records are securely stored and accessible during audits. Moreover, access controls and audit trails enhance data security and compliance.

How CRM Integration Supports Workflow Optimization

Integrating CRM with DMS and AR systems doesn’t just make processes faster, it also enhances the overall quality of work. Here’s how:

Speeding Up Client Onboarding:

Tax professionals must collect documents, set up payment systems, and initiate communication when a new client joins. An integrated CRM system simplifies this process by:

- Allowing clients to upload documents directly to a secure portal.

- Automating onboarding emails and payment setups.

- Consolidating all information into a single client profile.

Facilitating Real-Time Reporting:

Tax professionals must often provide clients with real-time updates on their financial status or pending payments. Integrated systems make this possible by generating up-to-date reports at the click of a button.

Enhancing Customer Experience:

A streamlined workflow translates to better client service. Clients appreciate timely responses, accurate records, and seamless interactions—all facilitated by an integrated CRM system.

Steps to Successfully Implement CRM Integration

Identify Workflow Gaps

Find inefficient parts of your current process before you start integrating systems. Do you need to spend more time keeping track of bills? Do you need help getting a document? Understanding your pain points will help you make the combination work.

Choose the Right Tools

Not all CRM, DMS, or AR tools offer seamless integration. Choose compatible software solutions and provide robust integration features. Popular options include Salesforce, HubSpot, and QuickBooks.

Train Your Team

Introducing new systems requires proper training. Ensure all team members understand how to use the integrated tools to maximize efficiency.

Monitor and Optimize

After integration, monitor the system’s performance daily. Get comments from your team to identify areas for improvement and then make the necessary changes.

Future Trends in CRM Integration

As technology evolves, the future of CRM integration looks promising for tax professionals. Here are some emerging trends to watch:

AI-Powered Insights: Artificial intelligence can analyze client data to offer predictive insights, helping tax professionals provide more strategic advice.

Blockchain for Secure Transactions: Blockchain technology can enhance the security of financial records and transactions within integrated systems.

Cloud-Based Solutions: Cloud integration allows professionals to access client data from anywhere, enabling remote work and better collaboration.

The Tax Industry’s Prospect for CRM

Tax sector CRMs have excellent prospects since artificial intelligence (AI) and machine learning drive many advances. Predicting future demands using client behavior, predictive analytics—powered CRMs allow proactive involvement. Routine task automation by CRMs will free time for strategic activities by progressively automating repetitive chores, including client follow-ups and document collecting.

Growing worries about data privacy will drive future CRMs to concentrate on solid encryption and adherence to changing laws. As remote work grows more common, mobile-friendly CRMs let tax professionals operate effectively from anywhere.

CRM Success Stories: How Tax Practices Achieved Growth with CRM Implementation

Customer relationship management (CRM) solutions have revolutionized companies in various fields with their simplified processes, improved client involvement, and quantifiable development. The tax business is no exception. This paper investigates three cases of tax companies using CRM systems to overcome obstacles, streamline processes, and attain steady development.

Automating Client Engagement

The Difficulties

Managing over 1,000 leads daily for tax preparation and settlement was challenging for the tax resolution company Community Tax. Tax procedures are naturally intricate, including several touchpoints for every client. The company wanted a solution to prioritize customer experience and link processes across divisions. Their current hand-crafted procedures needed to be more cohesive and were time-consuming.

The fix

Community Tax automated its high-touch procedures using SugarCRM and working with Nablasol. This included:

- CRM integrations in marketing and lead management streamline lead monitoring and nurturing.

- While clients were still on the call, the software automatically generated forms with emailed safe links for signatures.

- Automated client call routing based on caller ID guarantees clients reach the correct service representative without repeated transfers.

Achievements

Community Tax’s operations were transformed by automation, which also let the company:

- Enroll eighty percent of your customers on the same day; usually, you close sales on the first call.

- See the customer journey macro and departmentally.

- Create a combined data ecosystem that improves operational effectiveness and customer service.

- This change emphasizes how much consumer involvement and business expansion depend on an adequately applied CRM system.

Platform for Industry Review: Giving Tax Resolution Companies Digital Profile

The Difficult Challenge

Low trust and little internet presence dogged the U.S. tax resolution business. While consumers could not assess and compare services, tax resolution companies battled to provide qualifying leads. Unethical behavior and scams further undermined consumer confidence.

The fix

Nablasol created an industry review website to close this disparity. Salient characteristics included:

Comparative Firm Reviews: These reviews comprise 71 companies ranked according to various criteria, including attorney availability, accreditations, and service breadth.

Technical SEO: The site attracted many visitors because Google gave it excellent marks for competitive industry keywords.

Lead Generation: The system linked possible customers straight to companies with a “Get Help” button next to every company name.

Achievements

For consumers and tax resolution companies, the website has become an essential tool:

Enhanced Transparency: Armed consumers with accurate, thorough knowledge.

Qualified Leads: Created leads for companies to simplify customer acquisition.

Industry Transformation: Enhanced tax resolution space consumer confidence and credibility.

Leveraging a robust digital strategy, the review platform resolved structural issues and restored industry credibility.

Maximizing Marketing ROI with Advanced Attribution

The Challenge

Evaluating the efficacy of more than 100 lead sources—including PPC advertising, radio commercials, email campaigns, and referrals—challenged a tax service company. Effective marketing channels were elusive, given the intricacy of changing lead statuses and varying vendor invoicing.

The Remedy

Nablasol developed a sophisticated attribution technique to examine lead sources and maximize marketing plans. Notable breakthroughs included:

The LTV: CAC ratio is a KPI that gauges client lifetime value (LTV) against customer acquisition costs (CAC).

Dynamic Campaign Notables: specific knowledge about campaign and keyword performance.

Radio Advertising Optimization: Found the best times and stations for advertising broadcasts,

Automated invoicing simplifies vendor payments and integrates changing sales data.

Achievements

The attribution system produced transforming results:

Enhanced Conversion Rates: Found and ranked top-performing lead sources.

Shifted spending from underperforming to profitable sources helped to cut marketing costs.

Actionable Insights: Given a single dashboard for leadership, enable wise judgments.

Along with improving profitability and expansion, this data-driven strategy simplified marketing initiatives.

The industry review tool, Community Tax, and the marketing attribution model’s success stories underline how transforming CRM solutions can be in the tax sector. Here are some important lessons:

- Automating tedious chores lowers mistakes, saves time, and increases client interaction.

- Data integration, such as consolidating data across departments, improves workflow and visibility.

- Customer-Centered Solutions Client experience should be prioritized if one wants better retention and satisfaction levels.

- Decisions Based on Data Improve return on investment (LTV): CAC and other metrics offer practical information for optimizing marketing initiatives.

- Modern Instruments promotes consumer confidence and industry credibility through platforms that support openness and accessibility.

Conclusion

A CRM is a game-changing tool for tax experts who want to attract new clients and retain existing ones. It allows law firms to provide excellent service by streamlining tasks, improving communication, and using data insights.

When picking the right CRM, it’s essential to consider your company’s wants and long-term goals. Implementation may have problems, but the benefits are worth much more than the original cost. As technology changes, CRMs will continue to change the tax field, making it easier for professionals to succeed in an increasingly competitive field.

Using a CRM, Tax experts can ensure their businesses stay client-focused, efficient, and ready for the future. This wise investment will make your clients happier and make your company a known leader in the tax field.